Summary of the 2022 interview with the President and CEO

2022 was a record year for Trelleborg despite major challenges in the operating environment. A historic decision was taken to divest the Group’s tire operation, which has been part of Trelleborg since the very start in 1905. Due to its position as market leader, the Group could essentially manage cost increases. Investment continues to improve the Group’s geographic balance, concentrating on Asia. The Group continues to allocate resources to growth areas such as aerospace, healthcare & medical as well as electrification and industrial automation, together with several other growth areas in other industry niches. The acquisition of Minnesota Rubber & Plastics redrew the map for the Group’s sealing operation in North America and strengthens Trelleborg in selected industries. With its position as the sustainability leader in its industry, Trelleborg has more ambitious targets in the area than its competitors.

Trelleborg’s business concept is to seal, damp and protect critical applications in demanding environments.

The Group’s strategy is to secure leading positions in selected industries and geographies.

- Aerospace

- Automotive

- Healthcare & medical

- General industry

In these industries, Trelleborg is further positioning itself in attractive niches or product categories with the aim, in each individual case, of being among the three top players in terms of market share. The portfolio is composed so that, as a whole, its market exposure is less cyclical, which improves the Group’s prospects to report consistent earnings even when adverse fluctuations in the industrial cycle of individual industries occur. Trelleborg’s distinctly decentralized organization means business decisions are made as close to the customer as possible, which creates competitive flexibility with substantial market and customer knowledge.

The core of Trelleborg’s product development is engineered polymer solutions that meet customer-specific requirements for functional properties that seal, damp or protect critical applications. The Group has expertise in materials technology and has in-depth knowledge of customer applications and challenges. Trelleborg also offers various services supported by digital tools to make life easier and increase value for its customers. Moreover, there are examples within Trelleborg of businesses where the focus is on services rather that products. This part of the Group has grown and will grow over time and, together with its products, will provide the Group with a stronger position throughout the value chain.

The Group is distinguished by its material and applications know-how, industry insight in cutting-edge areas, and innovation capability. Trelleborg therefore has a clear advantage when it comes to creating long-term value for shareholders: its focus on niches in industries of the future, a high level of expertise and the entry barriers the niches have for competitors.

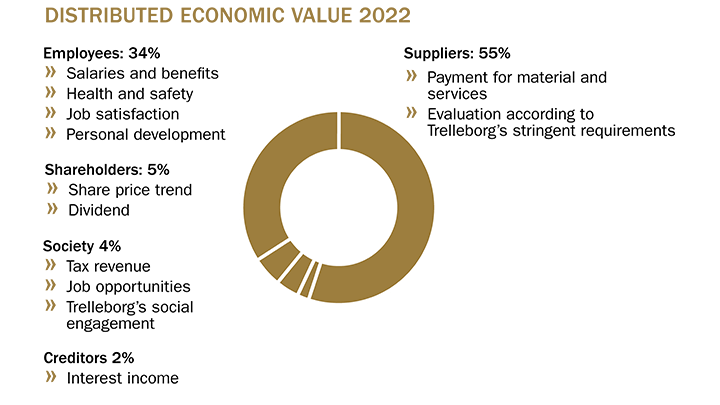

In total in 2022, Trelleborg generated economic value totaling SEK 30,571 M. This value includes all forms of revenue, where customers account for the largest portion.