Tackling your most important issues

When you explore oil and gas fields or tap into more challenging sources you must operate in increasingly harsh and tough conditions. With Trelleborg’s engineered solutions you can rely on equipment durability, increased safety and compatibility.

Trelleborg’s engineered solutions for the oil and gas industry are developed using innovative, high-performance materials to protect and damp in even the toughest of conditions.

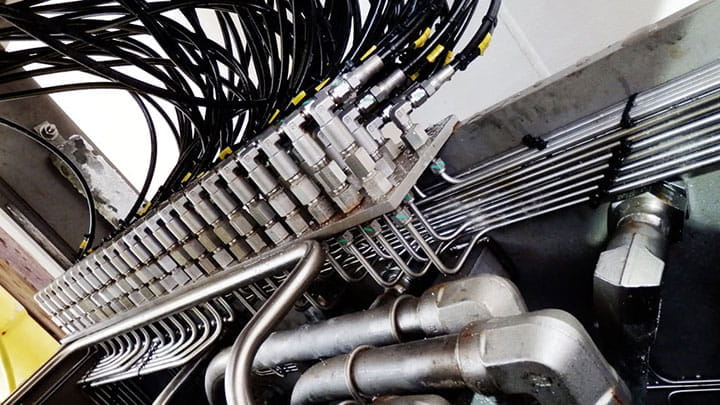

Topside & Maintenance and Modification Offshore (MMO)

Protection, systems and technology on rigs and FPSOs.

Oil & Gas Transfer

Solutions for transfer of crude oil and liquefied natural gas offshore and in terminals.

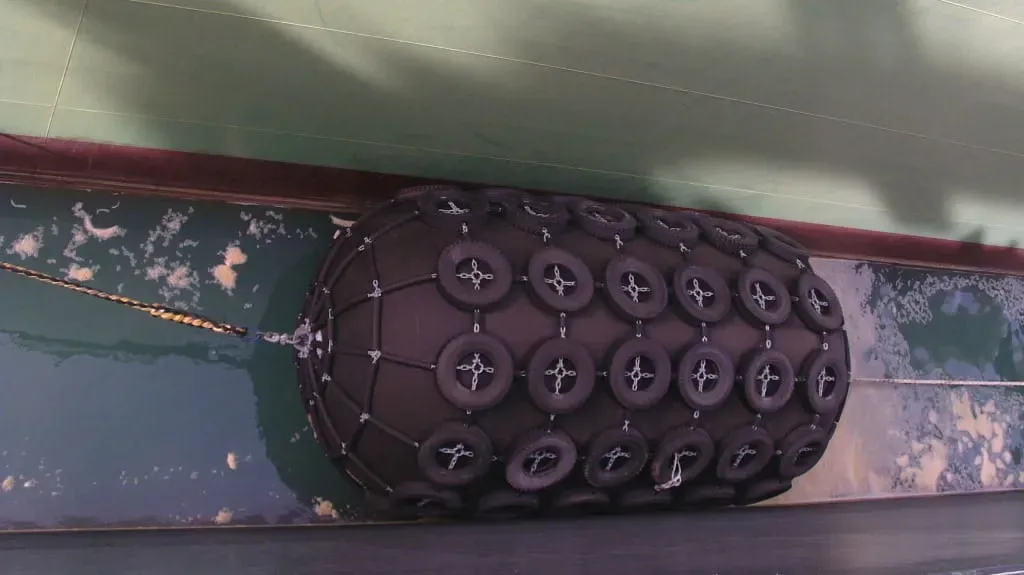

Surface

Buoyancy and protection for vessels, port facilities and in open sea.

Subsea

Buoyancy, clamping and protection under water.

Refining Production

Oil & gas technology in and out of refineries.